Invoicing and credit control

There are minimum legal requirements to be fulfilled when issuing an invoice.

However, how you handle credit control is mainly left to you.

The European Union has a framework for VAT invoicing. Individual member states do have slightly variant rules, though. Therefore, refer to your country’s inland revenue website to find out which requirements you have to fulfil when invoicing. For example, the UK rules on which details to include in your invoices are on the HMRC’s gov.uk website and searching for “invoicing”.

in these pages I aim to give you some hints as to what is useful to have on an invoice in addition to the obligatory information.

Invoice reference number

When you start up your translation business, don’t give your first invoice the number 1. That looks as if you’ve just started your business (and thus lack experience). Therefore, to instil some trust in your abilities, start, for example, with number 455. As long as you use consecutive numbers from then on, there is no reason why you can’t start with any number you choose. Rather, the rule is that the invoice number must be unique and sequential.

In addition, I also recommend to give invoices meaningful identifiers. For example, stick to your consecutive numbering but add some identifying letters like, 123ASD, whereby “ASD” stands for “Associated Sugar Distributors”. This way, when at some point you need to find the invoice for this company, you just look through your system and hunt for the initials. Obviously. this is much quicker than having to remember the number or checking all your invoices for the required period to find the one you want.

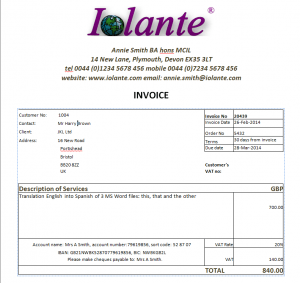

Layout

Firstly, design an invoice that is suited to your needs. Have a heading which clearly states all your business details at the top. Furthermore, make sure the space you leave in your template for the client’s address details is a) big enough to hold long addresses, b) is situated on your page in such a way that it is easily visible in letter windows. Having to print labels or rewrite the address again on windowless envelopes is labour-intensive. Avoid.

Details to include

When detailing the services you have rendered, be specific, not vague, for example, French-English translation of 350 word certificate of no impediment for John Smith. Minimum fee applies. Clearly. this helps you later when you try to remember what you charged for a certain job or to a certain client or why you charged them a specific fee.

In addition, state clearly all disbursements, include receipts with your invoice (First make copies for your own records.)

If you are exempt from charging VAT (for example if you live in the UK and your turnover is below a certain limit), state: “I am exempt from charging VAT as my company does not exceed the HM Revenue & Customs registration threshold, currently at £x.” This saves you from having to explain it to puzzled clients who may not be familiar with the system.

Credit control – Payment Terms

Include payment terms. When do you want the money by and how should the client send it? Who are cheques to be made payable to or, what are your account details for electronic transfers. First of all, consider your preferred payment terms. Agencies have their own terms they will automatically apply to all translators. However, you are more in control of payment terms for private clients. Therefore, you can insist on advance payments for translations, maybe providing alternate pages of the translation in pdf format as evidence that you have done the work, and only sending the client the translation after you have received payment. In the case of certified translations, you can send a draft together with your invoice and only certify the translation after receipt of payment. You can also negotiate payment terms with commercial companies.

Overpayment scams

Scammers are getting increasingly sophisitcated. They also target translators and other small businesses. Especially if you negotiate advance payments, you should be careful that you do not fall for overpayment scams.

Keep track of outstanding invoices

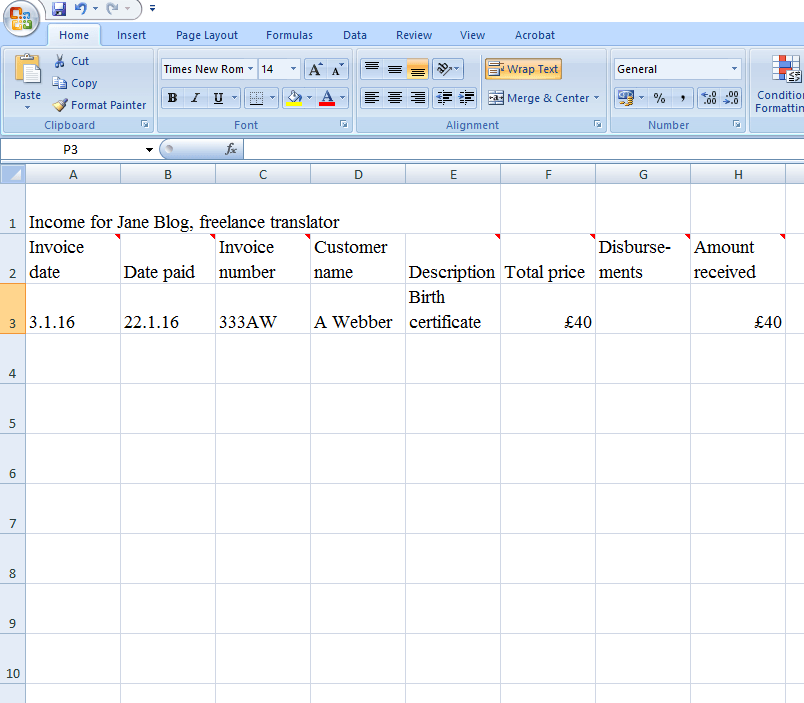

When you write up your invoices, enter them into a spreadsheet. Enter the most important details:

- Date of invoice

- Date paid

- Invoice number/identifier

- Customer name

- Job details

- Total price

- Disbursements

- Amount received

Keep a record of the date your invoice is paid to enable you to quickly get an idea how well your clients are paying and which (type of) clients are not. Additionally, always check the amount people send you against the invoice you wrote. The amounts sometimes don’t tally. Some customers overpay, some underpay, especially when exchange rates fluctuate. Check now to save yourself a lot of work later. Have a spreadsheet like this that gives you the income side of your accounts. Half the bookkeeping job done!

Use a credit control system

Have a checking system in place! Be in control of the credit you give by observing your own rules strictly. Never bend your own rules!

Here is a very simple credit control system: If you have printed invoices, have two trays, one with outstanding invoices, a second one for overdue invoices. Add new invoices to the bottom of the pile, that way the oldest invoices will always be at the top. Check every day which invoices have been paid (file away), which have not and which have become overdue. The moment they are overdue, contact the client.

Alternatively, you can also check in your income spreadsheet. Colour outstanding entries and remove the colour once the invoice has been paid. That way, you always have a clear visual overview of outstanding payments.

How to deal with late payers

Make sure your client has received the invoice. If they say they haven’t, immediately send them a copy (ask whom to send it to), adding one week only to the original term and stating, “This invoice is now overdue.” Later. when the seven days are up, contact them again (best to speak to someone on the phone), ask what the problem is. Point out that you are a sole trader and that you rely on your income to live. In the UK, you are covered by the UK Late Payment Law, if you’re in the EU, you are covered by the Late Payment Directive 2011/7/EU. Amongst other things, the legislation allows traders to charge a considerable amount of compensation plus interest for overdue accounts. Most companies will pay up as soon as you threaten to apply these charges.

Be clear who your client is. Some lawyers or other intermediaries will try to pay you only after the end client has paid them. Unless this is written down in their T&Cs, your client is the person or company or organisation who requested the translation from you. They are ultimately responsible for paying your invoice.

If you’re in the UK and owed money in the EU (or anywhere else in the world), you are no longer covered by the Late Payment Directive and there is no easy way of getting your money.

Options for getting paid

Your options for getting paid are:

- Evoke copyright

This works best is your client is a slow-paying agency. Contact them and tell them to inform their end client that the translation you provided can no longer be used, due to payment default. If that does not result in payment, escalate by stating that the translation must not be used as it is now subject to legal proceedings. The majority of clients will pay immediately. - Send a formal letter

This letter must comply with the regulations applying in the respective country. You can buy these letters for different countries from a company called Credit Limits International.

Legal action

Sometimes you hve to consider legal action to obtain your money. In most cases, the threat of legal action carefully outlined in an email is sufficient! In the UK, your first port of call is a court claim in what used to be called the small claim’s court. Information on the process can be found here.

Another option for getting payment from a commercial client is to threaten the client with a statutory demand, whereby the debtor has 21 days to either pay the debt or reach and agreement to pay. Should this fail, you can apply for the debtor to be declared insolvent. This is the nuclear option, I have never needed to action! The well-worded and evidence threat of a statutory demand is generally sufficient.

If you’re in the UK and need to recover money from anywhere outside the country, you could consider a debt collection agency. The above Credit Limits International offers free debt collection services.They recoup their costs from the debtor.